Dealing with a flooded home can be devastating, but it’s important to take action quickly in order to save your belongings, protect your finances, and prevent more harm to your property. When facing extensive water damage, a common consideration is this: Should I fix my flooded house, or try to find a prospective buyer for it? Let’s get into the details to help you make an informed decision.

Fixing vs Selling a Flooded Home in Houston

The decision to fully restore a house after water damage is usually based on money, but also the emotional toll it may take on you. Was there flood insurance in place? Depending upon where your property is located on the Houston area flood map, your insurance might be through a private carrier or directly through FEMA. What is the difference? From experience, there is a big one…

Flood Claim via Private Insurance Agent:

Unfortunately, all those funny and friendly insurance commercials competing for your insurance premiums when times are good fail to mention what it’s like during a flood damage claim.

History has demonstrated, particularly through Hurricane Katrina, that many claims adjusters for the big carriers such as State Farm have denied claims that otherwise should have been covered. In the linked NPR article, “Two adjusters who used to work for State Farm have stepped forward, turning over thousands of pages of documents which they say suggest the company willfully denied valid claims.” (Source: NPR November 7, 2006.)

This is unfortunate, and only adds insult to injury for an already struggling homeowner who lacks experience evaluating and litigating a flood policy.

Not every private insurance agent or carrier denies legitimate claims. Many will cooperate, and distribute insurance checks in order for you to fix your property. But just because they are eligible for reimbursement doesn’t mean every home owner wants to pursue fixing the property.

Considerations of Fixing Water Damage and Staying:

In the back of everyone’s mind who decides to fix and stay is this. How often will does it flood in Houston, and will we experience flood water again in the near future? Of course, this can be hard to predict.

Your home might be located in 500 year flood plain, or just outside of what is considered a flood risk area. But this is no assurance or guarantee of what you can expect.

Areas of Houston near the medical center have experienced repeated floods that “shouldn’t have happened.” Remember the Tax Day and Memorial Day floods?

The emotional energy expended in fixing your home is great, and the thought of facing future flooding is too much for some Houstonians to process.

Considerations of Fixing to Sell to a Home Buyer:

Most homeowners who qualify for a successful insurance claim to fix their home, but don’t wish to stay, consider listing it for sale. This is only logical, because they assume it’s not easy to find a house buyer who will want to purchase a damaged home as-is. This is fairly accurate from a traditional real estate perspective.

If you decide to go this route, there’s a few things to keep in mind that are necessary to recoup your Houston home value after a flood, and make your property attractive to potential buyers.

Make Sure You’ve Renovated the Plumbing: It’s crucial to hire a professional that can take a look at the plumbing system to make sure there’s no future risk for a potential buyer. This is especially true if you’re living in an older home, and haven’t performed maintenance on the plumbing system in a while.

Have the Home Inspected for Mold: Mold is a sure-fire way to detract any interest in your property, so it’s crucial to have your home inspected for any bit of mold present. If it is, mold remediation done with the proper documentation will be crucial to resale.

Flood-Proof the Home: Even though you won’t be living there, a buyer will be looking to see if you’ve taken the steps to help ensure a flood is less likely to happen again. This could include full renovation of windows, doors, and better grading for elevation.

Most homebuyers wish to buy a house they can immediately move into, and don’t have the funds (or desire) to fully renovate a flooded home.

Does it Always Make Sense to Fix Before Selling a Flooded Home?

With all that said, fixing your flooded house with the intention of resale is not always a wise idea. Why? This is what we have observed over the years, and why we caution people from taking this approach.

Every informed house buyer in Houston is going to look at the flood history of your property. This is going to happen regardless of just how nice the newly restored property looks during the open house. In fact, there are certain areas of Houston that have shown to repel home buyers when the flood history shows only one flood, while other areas of Houston do well with even 3 prior floods.

You need to be armed with this information before you go through the time, trouble, and expense of fixing your flooded home for the goal of resale. Many people have made the mistake of not understanding their realistic “exit strategy” when they are required to make a flood disclosure in the listing.

The Houston news has seen its share of stories of surprised home sellers who had to stomach unexpected price reductions in order to successfully appeal to a new buyer. This Houston energy executive had to reduce his selling price by almost $400,000 in an otherwise amazing and (previously) highly desirable Bellaire area.

The bottom line is this. Do your homework before you decide to fully restore your flooded home for resale. Your research might lead you to the conclusion that other options are better. This is one reason why people often consider a faster sale for cash, and avoid renovations altogether. We will discuss the cash buyer option in more detail shortly.

Private Insurance Flood Claim via FEMA Backed Insurance:

FEMA allows homeowners to purchase insurance through their network if your property is located in a floodplain. There are different definitions of risk, but to simplify, your home might be located in a 100 year vs 500 year flood zone. These estimate both the likelihood and frequency of potentially catastrophic future events.

It is also possible that property located in a high risk flood zone is not insurable, even through FEMA, but in most instances construction will simply be prohibited in these areas. They make several interactive tools available for you to check your base flood elevation compared to risk.

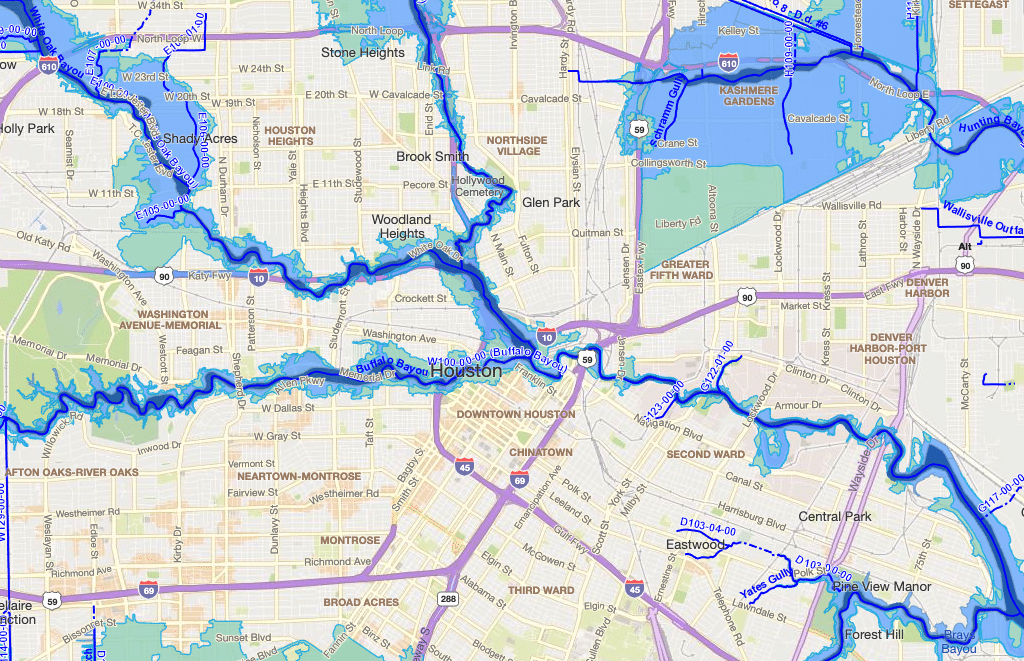

There are local tools available that focus on Harris county in Houston as well. You can enter your address, and get a stunning visual of the potential flood depths nearby. Below is a screenshot illustrating this:

The main takeaway is this. If your property is in a designed flood zone and you were approved for (and paid your premiums) your claim will be much easier than private pay. Why? These are federally allocated budgets for disasters, and don’t have to be approved by private adjusters or claims representatives.

While having a flood is not good news, the fact that your insurance is FEMA backed is.

Property Not Insured For Flood

It’s also possible that insuring your property was simply never done due to an oversight. Unfortunately, many property owners have learned the hard way that flood water is not typically covered under the average homeowner’s insurance policy.

In fact, underinsurance is perhaps the second most devastating factor after waters recede. Only 2 out of 10 people were insured during hurricane Harvey, as reported by the USA Today.

Even in cases where the property is deemed insurable, but located nearby a flood prone area, the cost of the insurance premium might be far out of reach.

This is frustrating for people who don’t live in a high risk flood zone, because they are helping to pay the price for the far-reaching financial affects of climate change and ever broadening FEMA flood maps. Private insurers have to pay for their claims somehow, and they do this by offsetting losses by higher premiums.

Homes in a flood zone are often self insured for this reason. This means that the cost to fully repair a home might far outstrip your budget. In addition, borrowing enough money might also be unrealistic or unattainable as well. This brings us to one of the most realistic options for flood victims when dealing with the decision to move on. What are the odds of finding a homebuyer?

Who is a Home Buyer for a House With Flood Damage?

Options do exist to help those living in the Houston area who have experienced this hardship firsthand. There is an alternative plan to fixing the property to sell, and the tough decision to stay but live with the concern of future flooding.

What if you can simply locate an investor who is comfortable taking on the flood risk? This is a viable way to solve your problem, and one that is worth seriously considering. Read on to learn how to sell a house that has flooded-fast, and for the most amount of money.

How to Sell a House That Has Flooded in Houston

Trying to sell a Houston house after a flood doesn’t have to be a drawn-out process littered with obstacles, especially if the property still has a lien on it such as a mortgage.

You can sell your property in as-is condition without having to worry about lengthly disclosures. We understand the situation, and fully expect worst case scenario when facilitating the transaction.

At PPS, we’ve seen it all – and we’re here to help you sell your flooded house quickly and easily, while making sure you receive the cash payment you deserve when we’re done.

Not only are flooded homes one of our many specialties, but we’ll see to it that your selling process is streamlined, meaning no stress for the seller at all.

When you trust PPS to buy your home, you can be sure:

You’ll never pay for repairs.

You’ll never pay any fees.

You’ll get a generous, fair, CASH offer.

We’ll handle the all the steps and title paperwork.

Remember, we are not a real estate agent but instead purchase homes directly for investment purposes. Trust the best when it comes to flooded homes for sale in Houston. We’ve done this before, and are here to help you.

Where Do You Go From Here?

By now, you’re probably seeing that to sell your flooded house means more than just one option than you previously thought. It’s true that there’s a lot of work involved if you try to do this yourself, but we can help guide you.

Learning how to sell a house that has flooded can be a lengthy and confusing process when dealing with the emotional burden of loss. Your best bet, and the only way to guarantee the maximum value with the least amount of stress, is by using a company that specializes in buying a house after a flood or severe water damage.

If you are also behind on mortgage payments, and are looking to sell the home before facing foreclosure, this becomes a more complicated process. We field a ton of questions from potential clients in Houston, asking “Can I sell my flooded home before the bank forecloses?” We can explain your options, the implications, and help you discover the best way forward.

What homeowners don’t realize is that there’s already many previously flooded homes for sale in Houston. Trying to sell your house after a flood can be difficult, but we’re here to tell you it can be done.

PPS is a team of reputable cash home buyers in Houston who can close fast. We will work with you to help sell your house after a flood.

We’ve been through it all, and we can help show you how to sell a house that has flooded in Houston – and end up in a better situation than you thought was possible!

Go it Alone?

We should be honest with you – trying to sell a Houston house after a flood isn’t always the easiest thing to do, especially if you’re trying to get it all done on your own. You absolutely need to ensure the details are handled properly to ensure selling a house after a flood goes off without a hitch.

FREE Consultation on Your Flooded Home

To learn more about handling an insurance claim for your property or selling your flooded home, please call PPS House Buyers at 281-306-5055 or fill out our simple online form